In an era where digital transformation is paramount, the rise of digital wallet (e-wallet) apps signifies a major shift in financial transactions. The global digital payments market, projected to reach $14.79 trillion by 2027, reflects a society rapidly moving towards cashless solutions. This article delves into the intricacies of creating a digital wallet, examining market trends, user benefits, essential features, and technological considerations. Whether you're a budding entrepreneur or an established business, understanding the landscape of digital wallets is crucial for staying competitive and relevant in the rapidly evolving digital economy.

Digital Wallet Market Overview

In recent years, the digital wallet market has seen explosive growth, revolutionizing the way financial transactions are conducted. In this section, we'll examine the current state of the digital wallet market, exploring its size, growth patterns, and potential future trends.

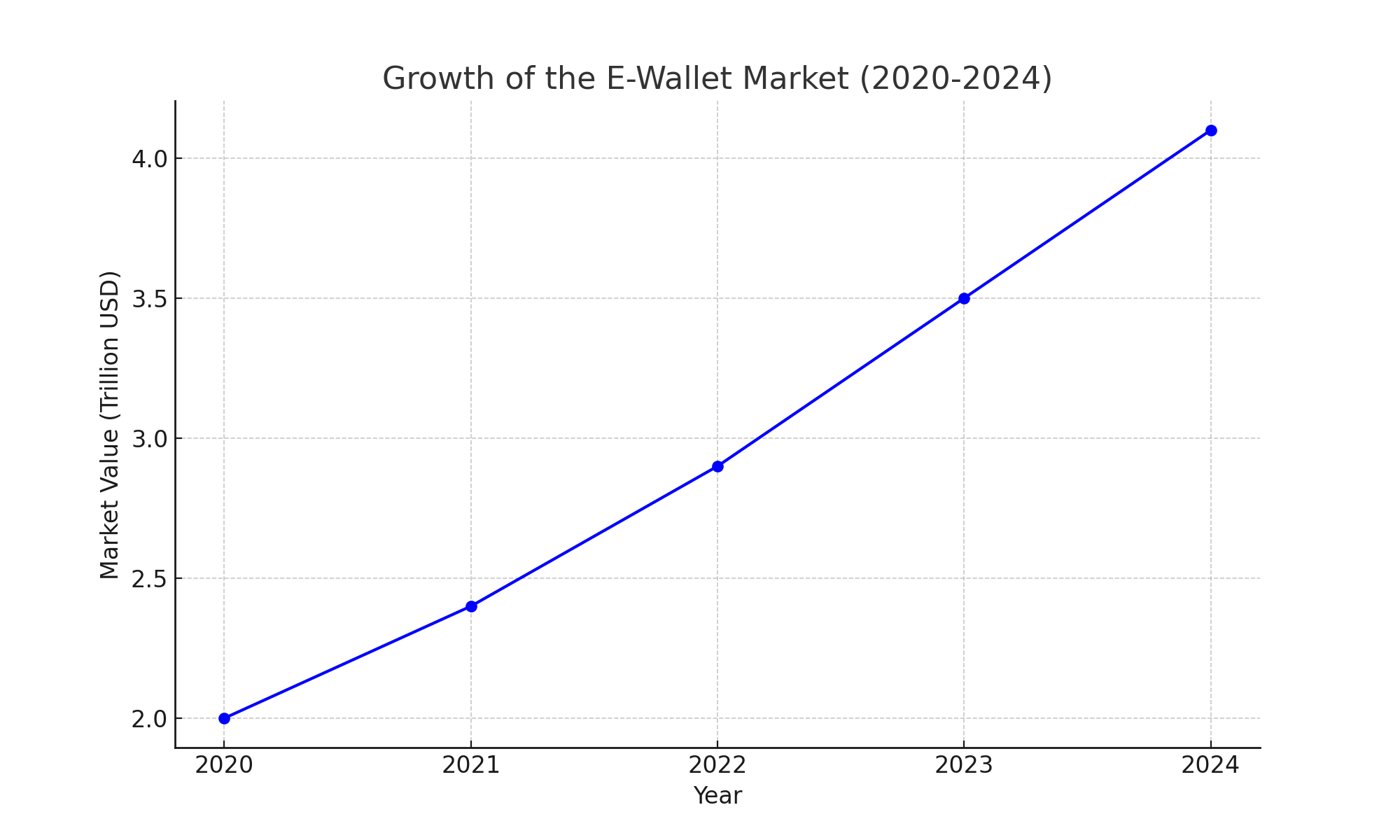

- Growth of the e-wallet market (2020-2024): This line graph shows the steady rise in the market value of e-wallets, from $2.0 trillion in 2020 to a projected $4.1 trillion by 2024, highlighting the industry's robust growth.

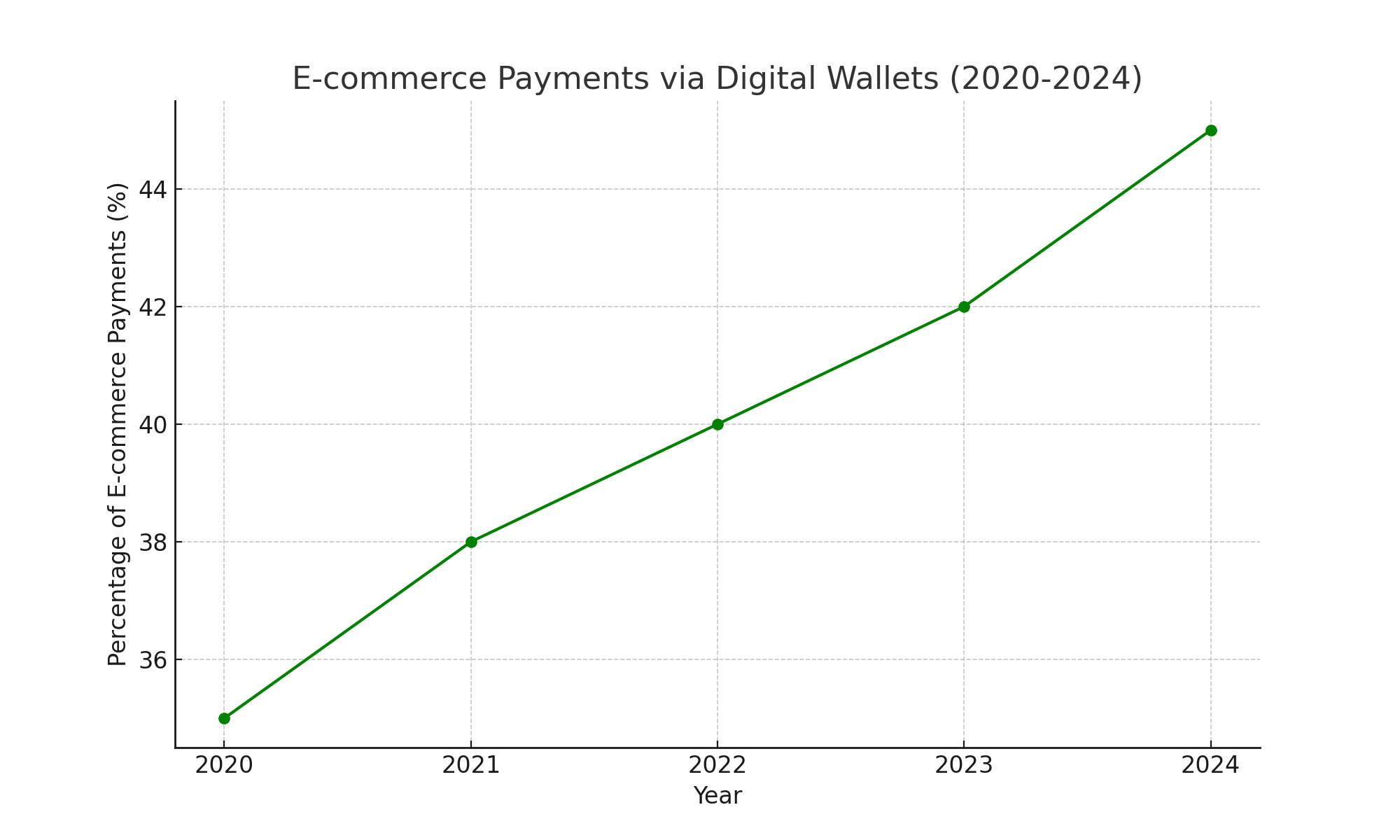

- E-commerce payments via digital wallets (2020-2024): This graph tracks the increasing percentage of e-commerce payments made via digital wallets. Starting from 35% in 2020, it shows a steady rise, reaching an expected 45% by 2024, indicating growing consumer preference for digital wallet transactions in e-commerce.

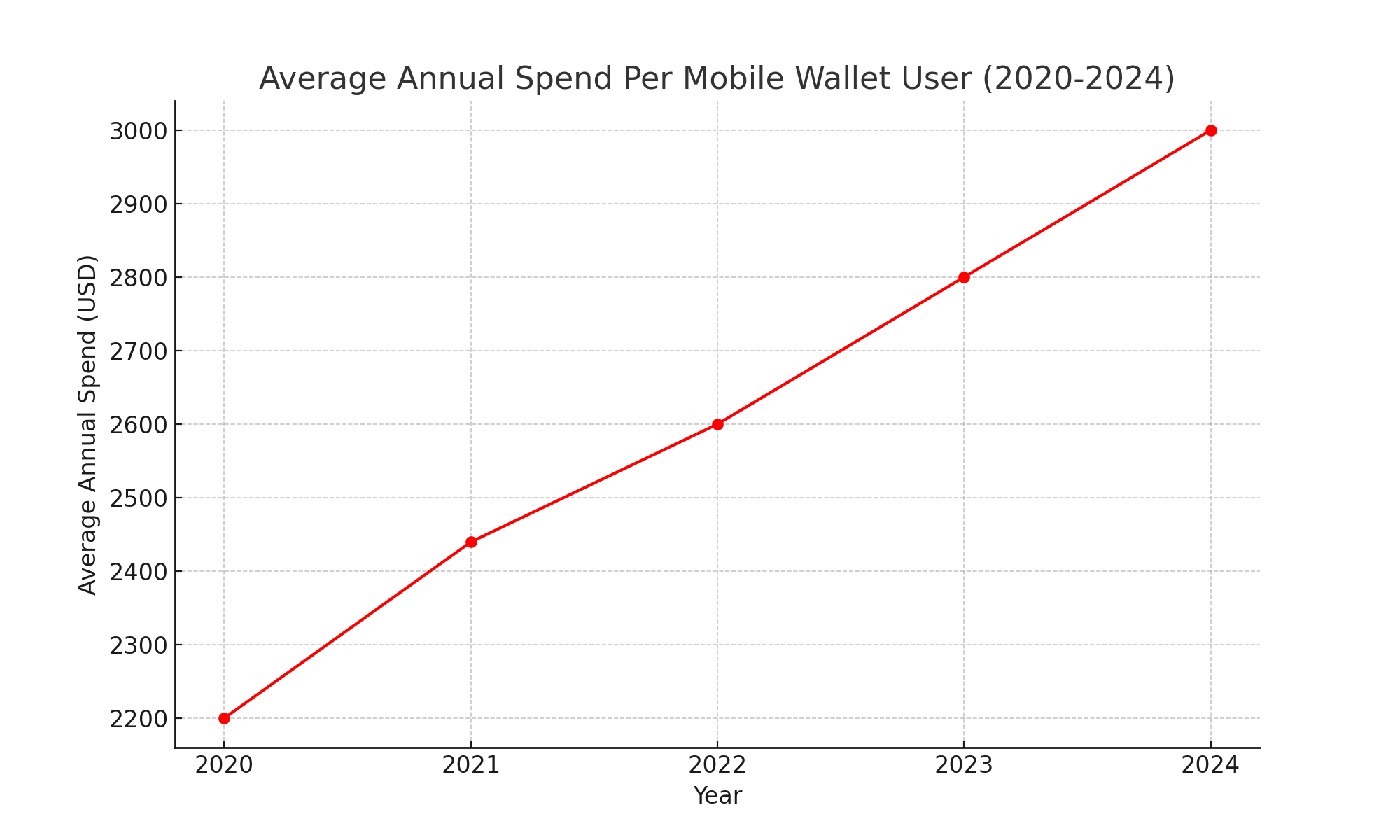

- Average annual spend per mobile wallet user (2020-2024): The graph depicts a consistent increase in the average annual spending per mobile wallet user, from $2,200 in 2020 to an anticipated $3,000 by 2024. This trend suggests increasing reliance and trust in mobile wallet transactions among users.

Why To Create A Digital Wallet: Benefits For Your Business

In an era where digital convenience is king, implementing a digital wallet is crucial for any forward-thinking business. This section explores the key benefits of digital wallets, from enhancing customer experience to bolstering security, and how they can give your business a competitive edge in the digital marketplace. Let's explore more details:

Enhancing customer experience

- Convenience and speed: Digital wallets streamline the payment process, allowing customers to complete transactions with just a few clicks or taps. This ease of use significantly enhances the customer experience, leading to increased satisfaction and loyalty.

- Personalized user experience: Digital wallets can offer personalized experiences by remembering user preferences and providing tailored recommendations. This level of customization not only improves user engagement but also encourages repeated usage.

Competitive edge in the market

- Staying ahead in a digital world: In an era where digital solutions are rapidly becoming the norm, offering a digital wallet positions your business as forward-thinking and adaptable. It demonstrates a commitment to embracing new technologies, which can be a key differentiator in a crowded market.

- Expanding customer base: By offering a digital wallet, you open up your services to a broader audience, including tech-savvy consumers and those who prefer cashless transactions. This expansion can lead to increased sales and a more diverse customer base.

Increased revenue opportunities

- Higher transaction volume: Digital wallets can lead to more frequent purchases. The ease and convenience of use encourage users to transact more often, potentially increasing overall sales volume.

- Cross-selling and upselling opportunities: With the data gathered from digital wallet transactions, businesses can effectively cross-sell and upsell relevant products or services, thereby increasing the average transaction value.

Streamlined operations

- Reduced transaction costs: Digital wallets often have lower transaction fees compared to traditional payment methods. This cost-effectiveness can be particularly beneficial for small and medium-sized businesses.

- Efficient transaction management: The ability to track and manage transactions easily is another benefit. Digital wallets offer detailed transaction histories, making accounting and financial management more efficient.

Gaining valuable insights

- Data analytics: Digital wallets provide access to valuable consumer data, such as spending patterns and preferences. This data can be analyzed to make informed business decisions, tailor marketing strategies, and enhance the overall product or service offering.

Types of Mobile Wallet Apps

In the diverse world of mobile payments, understanding the various types of digital wallets is essential for tailoring solutions that meet specific user needs. This section provides an insightful overview of the different types of mobile wallet apps, from closed and open wallets to niche and hybrid solutions, each with its unique features and use cases. Discover how these varied types can influence your digital wallet strategy and user experience. Let's dive into each of them:

Closed wallets

Closed wallets are digital wallets offered by a specific company to its customers for transactions exclusively within the company's ecosystem. These wallets can only be used for purchasing goods and services from the wallet provider. A classic example is a store-specific wallet, which allows customers to load money and make purchases only within that particular store or chain. These wallets often offer loyalty points or rewards, enhancing customer retention.

📱 Real-world examples:

- Amazon Pay: A closed wallet provided by Amazon, allowing users to make purchases on Amazon's platform using funds loaded into their wallet.

- Starbucks App: Users can load money onto their Starbucks account and use the app to pay for purchases only at Starbucks outlets. The app also integrates a rewards program, offering points for purchases that can be redeemed for free drinks and food.

Semi-closed wallets

Semi-closed wallets enable users to conduct transactions at listed merchants and locations. Unlike closed wallets, they aren't restricted to a single company's ecosystem but still have limitations on where they can be used. These wallets are accepted within a specific network of merchants that have a contract with the wallet provider. This arrangement offers users more flexibility compared to closed wallets while still providing a controlled environment for transactions.

📱 Real-world examples:

- Paytm: An Indian digital payment system that allows users to deposit money into an integrated wallet and use it for transactions at various merchants that have agreements with Paytm.

Open wallets

Open wallets are the most versatile type of digital wallet. They are typically issued by banks or financial institutions and allow users to make purchases, withdraw cash at ATMs, and transfer funds. Their partnership with banks often means they adhere to strict financial regulations, offering users a high level of security and trust. These wallets mirror traditional banking services while providing the convenience of digital transactions.

📱 Real-world examples:

- Google Pay: Google Pay, initially launched as Android Pay, is an open wallet that allows users to make payments across various platforms and locations. It is linked to the user's bank account or credit card and can be used for in-store purchases, online transactions, and even ATM withdrawals, wherever accepted.

- Apple Pay: Linked to users' bank accounts, Apple Pay allows for a wide range of transactions, including in-store purchases, online shopping, and even cash withdrawals in some cases.

Niche wallets

Niche wallets cater to specific market segments or use cases. They are designed to address the unique needs of a particular audience or industry, such as wallets for cryptocurrency transactions or for specific types of rewards. These wallets offer specialized features and functionalities tailored to their target audience, such as enhanced security for cryptocurrency transactions or integrated tools for managing loyalty points in various retail environments.

📱 Real-world examples:

- Binance App: This is a specialized wallet primarily for cryptocurrency users. Binance offers a secure and comprehensive platform for trading, storing, and managing a wide range of cryptocurrencies. It's designed for those engaged in cryptocurrency investments and trading, providing tools and features specific to the crypto market.

Hybrid wallets

Hybrid wallets blend characteristics of open, closed, and semi-closed wallets. They offer a versatile solution that caters to a wide range of transactional needs. By combining various features, hybrid wallets appeal to a broader user base, offering the convenience of open wallets with the added benefits of closed or semi-closed systems.

📱 Real-world examples:

PayPal: Initially a semi-closed wallet, PayPal has evolved into a hybrid system allowing users to store money, make purchases at a vast number of online and physical stores, and withdraw funds to their bank accounts.

Prepaid mobile wallets

Prepaid mobile wallets are digital wallets where users load funds in advance before making transactions. These wallets do not necessarily need to be linked to a bank account. Users top up the wallet with a set amount of money and use the funds for various transactions until the balance depletes.

📱 Real-world examples:

- Walmart MoneyCard: The Walmart MoneyCard is a prepaid debit card that can be loaded with funds for use. It's a convenient option for customers who want to manage their spending or do not have access to traditional banking services. It's widely used for everyday purchases, both in Walmart stores and elsewhere.

Must-Have Features of Digital Wallet

In the rapidly evolving digital payment landscape, a digital wallet needs to offer not only convenience but also security and versatility. Below is a table outlining the essential features that should be incorporated into any digital wallet to ensure it meets the needs of modern consumers and stands out in the competitive market.

| Feature | Description |

|---|---|

| User-friendly interface | Intuitive navigation, clear instructions, and a clean design for ease of use. |

| Robust security measures | Advanced security like 2FA, encryption, and biometric authentication. |

| Multiple payment options | Support for various payment methods including cards, bank transfers, and cryptocurrency. |

| Real-time transaction notifications | Instant alerts for every transaction to track spending and detect unauthorized activities. |

| Seamless money transfers | Easy P2P transfers, QR code scanning for payments, and money request options. |

| Loyalty and rewards integration | Loyalty programs with points accumulation, discounts, and personalized offers. |

| Transaction history | Comprehensive and navigable history of past transactions with detailed information. |

| Budgeting and expense tracking | Tools to manage finances, set spending limits, and gain insights into spending patterns. |

| Cross-platform compatibility | Consistent user experience across different platforms like iOS, Android, and web. |

| Customer support | Accessible support through multiple channels and comprehensive help resources. |

| Integration with other services | Capability to link with e-commerce platforms, utility services, and more for added convenience. |

| Offline functionality | Limited operations without internet connectivity using technologies like NFC. |

5 Steps to Create a Digital Wallet App

Embarking on the journey of creating a digital wallet app involves a blend of strategic planning, technological insight, and user-centric design. This section outlines the five essential steps in developing a successful digital wallet app, from initial market research to the final launch and continuous improvement. Each step is crafted to guide you through the process, ensuring your digital wallet not only meets but exceeds market expectations.

Step 1: Design and prototype

- Research and understanding: Begin by researching your target audience. Understand their spending habits, preferred payment methods, and security concerns. Analyze competitors to identify gaps in the market.

- Feature planning: Decide on the key features of your wallet, such as payment options, loyalty programs, and support for multiple currencies.

- Creating a prototype: Design a prototype of your app. This should be a clickable model that demonstrates the user interface and experience. Use this prototype to gather feedback from potential users and refine your design accordingly.

Step 2: Develop the wallet

- Choosing the right technology stack: For your digital wallet app, choose technologies that ensure optimal performance, security, and scalability. While Swift (iOS) and Kotlin (Android) are common for front-end development, and Java or Node.js for back-end, using different languages for each platform can be costly. Flutter offers a cost-effective alternative for efficient cross-platform development, demonstrated by its success in the Binance app, adept at handling complex financial applications.

- Security emphasis: Implement robust security measures including encryption, two-factor authentication, and compliance with financial regulations like PCI DSS.

- API integration: Develop APIs for integration with different payment gateways, banks, and other financial services. Ensure these integrations are secure and efficient.

Step 3: Test thoroughly

- Functional testing: Ensure all features work as intended. This includes testing payment processing, user registration, and other core functionalities.

- Security testing: Conduct rigorous security testing to identify and fix vulnerabilities. This is crucial to protect user data and financial transactions.

- User experience testing: Test the app for ease of use, navigability, and overall user experience. This can involve beta testing with a select group of users.

Step 4: Release and maintain

- Compliance and guidelines: Before release, ensure your app complies with all relevant app store guidelines and legal requirements in the jurisdictions you plan to operate in.

- Launch: Release your app on the appropriate platforms. Ensure you have a marketing strategy in place to promote the app.

- Ongoing maintenance: Regularly update the app for security, introduce new features based on user feedback, and ensure compatibility with the latest OS versions.

Step 5: Analyze and iterate

- User feedback and data analysis: After launch, collect user feedback and analyze usage data to understand how people are using your app.

- Iterative development: Continuously improve the app based on feedback and data. This might include adding new features, refining existing ones, or making UX/UI improvements.

- Scalability: As your user base grows, ensure that your app can scale effectively. This might involve upgrading your hosting solutions, optimizing your code, or expanding your customer support capabilities.

Challenges Of Developing A Digital Wallet

Creating a digital wallet app presents several significant challenges that developers and businesses need to navigate effectively. These challenges range from ensuring robust security to providing an intuitive user experience. Let’s delve into these:

Balancing UX with high security

- The paradox: Ensuring top-notch security often means adding more steps or layers to user interactions, which can negatively impact the user experience. Striking a balance where the app remains user-friendly while being impenetrable to security threats is a nuanced challenge.

- Biometric integration: Incorporating advanced security features like biometric authentication (fingerprint scanning, facial recognition) while ensuring they work seamlessly across various devices.

Real-time transaction processing

- Handling volume and speed: Digital wallets must process transactions in real-time while managing high volumes during peak times. This requires a robust backend architecture capable of handling thousands of transactions per second without latency.

- Instant feedback mechanism: Providing users with immediate confirmation of transactions, which requires a complex orchestration between the app, banks, and payment networks.

Cryptocurrency integration

- Technical complexity: Integrating support for cryptocurrencies adds another layer of complexity, given the volatility, security concerns, and regulatory ambiguity surrounding digital currencies.

- Blockchain integration: Seamlessly integrating blockchain technology for cryptocurrency transactions while maintaining the speed and user-friendliness of the app.

Multi-currency and cross-border transactions

- Currency conversion: Managing real-time currency conversions and cross-border regulations while keeping transaction fees reasonable.

- Regulatory compliance: Each country comes with its own set of financial regulations and compliance requirements, making international transactions particularly challenging.

AI and Machine Learning integration

- Fraud detection: Implementing AI for real-time fraud detection and prevention. This involves analyzing patterns and behaviors to flag unusual activities, a task that becomes increasingly complex with a growing user base.

- Personalized UX: Using machine learning algorithms to offer personalized financial advice, spending insights, and targeted offers, while ensuring privacy and data security.

Ecosystem creation

- Partner integrations: Creating a digital wallet isn’t just about the app itself, but also about building an ecosystem. This involves partnerships with retailers, loyalty programs, and other financial services, each with its own technical and business challenges.

- API management: Managing multiple APIs for different services and ensuring they work together flawlessly is a significant technical hurdle.

How Much Does It Cost to Build Your Own Digital Wallet App?

The cost of developing a digital wallet app varies significantly based on the complexity and features of the app. Generally, we can categorize digital wallet apps into three levels of complexity - basic, medium, and advanced - each with its own cost implications.

1. Basic digital wallet app

- Features: Includes fundamental features like user registration, basic transaction functionalities, simple UI, and basic security measures.

- Development time: Approximately 3-6 months.

- Cost estimate: Development costs for a basic app can range from $20,000 to $50,000. This cost can be higher depending on the region of the developers and any additional minimal features added.

2. Medium complexity app

- Features: In addition to basic features, it includes integration with multiple payment gateways, enhanced security features like two-factor authentication, a more sophisticated UX/UI design, and support for multiple currencies.

- Development time: Around 6-12 months.

- Cost estimate: The cost for a moderately complex app can range from $50,000 to $120,000. The increase in cost is due to the added complexity, better security features, and more refined design elements.

3. Advanced digital wallet app

- Features: High-end features such as biometric authentication, integration with banking APIs, support for cryptocurrency, advanced fraud detection systems, AI-based personal finance advice, and a highly interactive user interface.

- Development time: Could take over a year.

- Cost estimate: Building an advanced digital wallet app can cost anywhere from $120,000 to $250,000 or more. This higher cost is attributed to the cutting-edge technology required, extensive testing, and the need for high-level security and regulatory compliance.

Additional cost factors

- Maintenance and updates: Ongoing costs post-development for updates, bug fixes, and new features.

- Marketing and launch: Budget for marketing, promotional activities, and user acquisition strategies.

- Region of development team: Development costs can vary greatly depending on the geographic location of your development team.

Conclusion

As we wrap up this comprehensive guide on creating a digital wallet, it’s clear that the journey is as challenging as it is rewarding. From understanding the burgeoning e-wallet market to diving into the various types of wallet apps, and from outlining the indispensable features to walking you through the five critical steps of development, we have covered a broad spectrum of essential information to help you embark on this exciting venture.

Remember, the success of a digital wallet app hinges on understanding your audience, leveraging the right technology, and continuously evolving based on user feedback and market trends. Whether you choose Flutter or another platform, focus on creating a seamless, secure, and intuitive user experience.

If you’re ready to transform your digital payment offerings and carve out your niche in the digital wallet market, we are here to help. Contact us for expert guidance and support as you embark on this journey towards creating a digital wallet app that sets the standard in user convenience and security. Let’s build the future of digital payments together – your journey to innovation starts now.